- Shiny Thing$

- Posts

- 🫨 Your Cash Has ADHD

🫨 Your Cash Has ADHD

SHINY THING$ #207, by Rally

What happens when cash rushes back into the market?

Well, we have a few ideas…

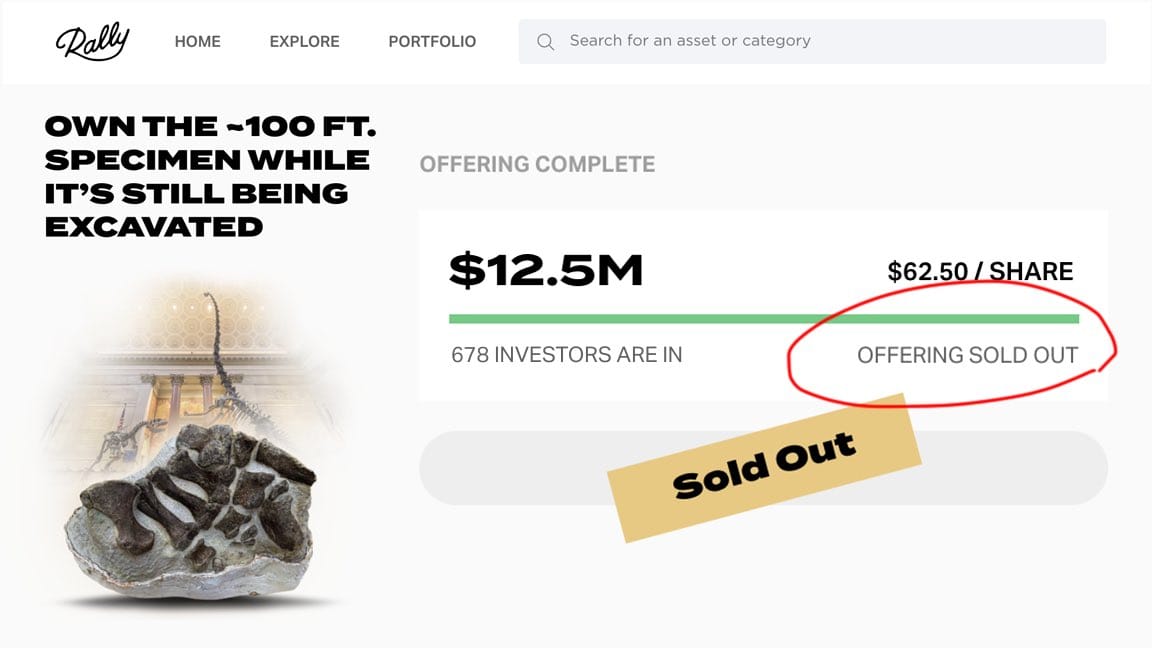

On Wednesday, with the public launch of our biggest IPO so far this year, a $12.5M 100-foot Barosaurus skeleton, we got a little preview.

In less than 7 minutes, all 200,000 shares were gone. And more than that, retail investors were spending more and requesting bigger blocks of equity than any other offering this year.

With the markets in the middle of a historic run and with the ever-increasing appetite for nontraditional investment vehicles, we can see where the trend is headed. Auctions are setting new records, private sales of trading cards are eclipsing 2021 numbers, and prediction markets and leveraged ETFs are quickly becoming part of every retail trading strategy. The money is certainly there.

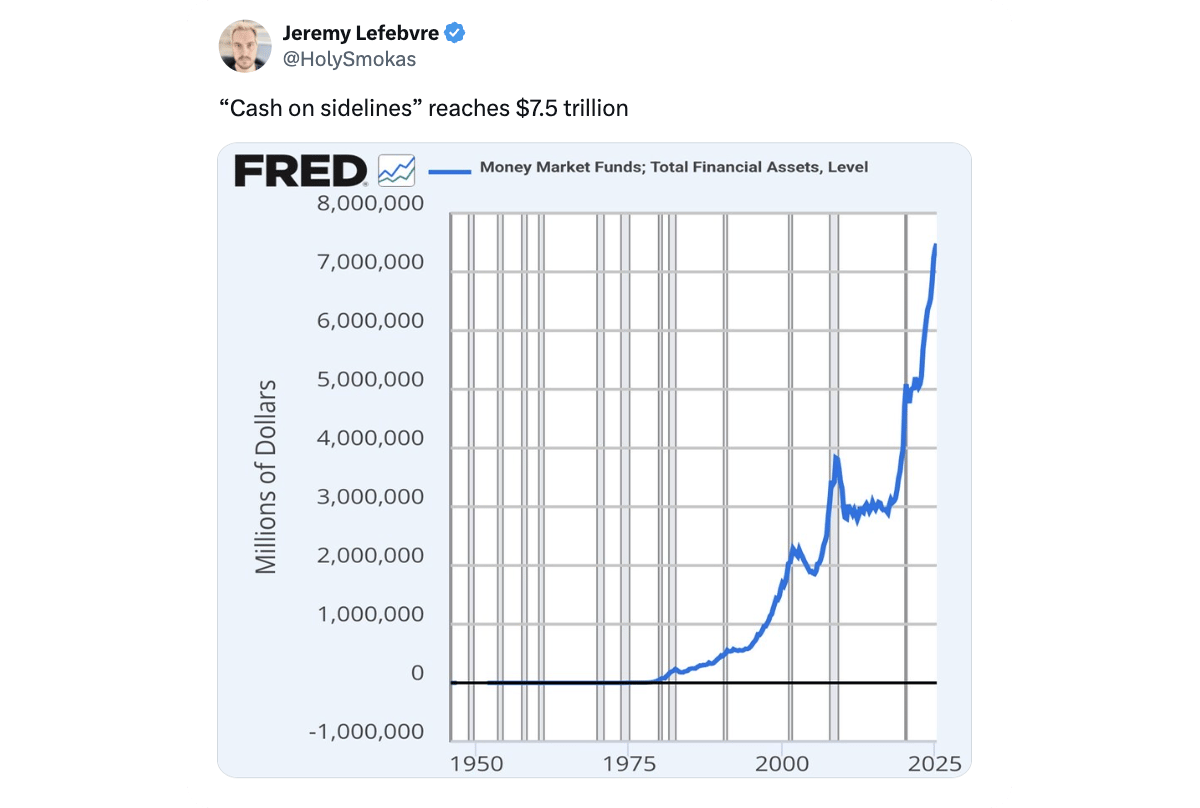

The most interesting part of all of this was articulated in a tweet I saw earlier this week - cash on the sidelines is at an all time high.

Let me also say that the actual access-to and deployment-of that “cash” is part of a bigger debate of whether all that money is actually a mix of cash in bonds “waiting for a crash,” in the accounts of corporations and being used for operations, and whether or not its truly investable cash as opposed to money already-in-play…

But the overall consensus is that much of it is yet to be put into true “risk assets.”

That means more people are holding more underinvested money-market assets and cash-equivalents than at any point in history. It’s a wild dichotomy as prices of basically everything continue their march up-and-to-the-right like an unstoppable rebel-force.

This week, in the 207th edition of Shiny Things, we’ll explore why so much cash has accumulated, how retail investors have been surprisingly active despite the cash pile, and what it all could imply for markets - both traditional, alternative, and even prehistoric.

[And just to cover all bases and keep the lawyers happy, this is NOT financial advice, and should not under any circumstances be taken as such].

Trillions Waiting to Move

If you believe the hype, there’s a record $7.5 trillion sitting on the sidelines right now - in money markets, T-bills, and other interest-bearing accounts, no matter how you cut it. That’s more than ever before. For context, it’s roughly equal to the combined market caps of Apple and Microsoft… twice over.

It’s what the markets can refer to as “dry powder” - money waiting for a reason to re-enter the equities or risk-on markets.

The trillion dollar question: if that truly is free cash, if/when it does get back in the game, where will it go?

After years of zero yields, cash suddenly pays. A 5% return on a money-market fund feels like a safe luxury after the chaos of 2022. Why gamble when “risk-free” pays enough? At the same time, bonds kinda lost their usual appeal. The yield curve flipped, long-term Treasuries crashed and tariff convos took over the financial zeitgeist, and short-term cash became king. Add inflation anxiety, geopolitical messiness, and a few banking scares, and you get the perfect environment for hoarding liquidity.

Even corporations joined in - roughly two-thirds of that $7T sits in institutional accounts, not retail. For much of 2024, cash was the ultimate defensive trade.

Meanwhile, retail is CRUSHING.

The irony? Retail investors aren’t the ones sitting it out.

Household stock allocations are near all-time highs, while their cash balances haven’t ballooned the same way. Retail trading volumes are still massive — on some recent days, they’ve made up a third of all U.S. equity trading.

Vanda Research estimates retail investors added over $150 billion to stocks and ETFs in just the first half of 2025 - their biggest six-month inflow ever.

In other words, the “cash on the sidelines” isn’t Main Street waiting to jump in. It’s big money - institutions, companies, and HNW investors - biding time until the Fed blinks.

But we’ve seen this movie before…

In early 2009, after the financial crisis, money market assets hit $3.7T - then an all-time high. Investors were terrified. But once the Fed cut rates and confidence returned, that cash started dripping into risk assets. The S&P 500 doubled in less than four years.

It happened again after COVID: trillions parked in savings and money markets. As rates collapsed, that cash rushed into stocks, crypto, real estate, and collectibles - fueling one of the wildest bull markets in modern history (and without question, partly contributing to Rally’s world record sale of $2 million sealed original Mario Bros video game - a price that the game market thought wouldn’t stand for too long, but remains today).

The pattern is simple: high cash levels are usually a contrarian buy signal.

Fear creates lots of dry powder.

Confidence lights the fuse…

When the Fuse Gets Lit This Time…

If history rhymes, a few things could unlock this mountain of cash:

Fed cuts → once yields fall below 4%, cash sitting in a bank account gets WAY harder to justify.

FOMO → markets of all kinds are making weekly highs. As insane as it sounds, 5% in a fund starts to feel like watching the party through the window.

Stability → less volatility and fewer black-swans draw the hesitant back in. The recent dips are getting bought by retail aggressively.

Even a small rotation could be seismic. If just 10% of that $7.5T moves into equities, that’s $750B of fresh demand - about the same scale as the entire market cap of Meta.

If it moved into alts, the entire landscape would change overnight.

When liquidity returns, it doesn’t just lift stocks. It bleeds into everything - cars, art, cards, watches, whisky, sneakers. We saw it in 2021: trillions in stimulus, record stock prices, and collectibles exploding. A Charizard card sold for $400K, sneakers flipped like stocks, and dinosaurs - literally - hit the market.

Nothing is guaranteed, but as rates fall again and cash loosens up, the same dynamic could return. Money chases narrative. Retail chases story. And alt assets live at that intersection.

Just this past week, we saw one of the highest-return card buyout offers since the pandemic - a $300K Pokemon Charizard offer in the middle of one of the hottest moments for Pokemon since 2021’s peak.

Sound familiar?

The Bottom Line

A record cash pile doesn’t signal apathy - it signals potential energy. When the dam breaks, it won’t trickle. It’ll surge, regardless of the gains that have occurred over the period that cash has been sidelined.

Retail is already playing. Institutions are waiting for the green light. And when they step back in, the spillover could be felt across every corner of the market - from the S&P to the auction block.

Because in markets, as in nature, money doesn’t like to sit still…

Until Next Week…