- Shiny Thing$

- Posts

- We Saw Your Screenshots

We Saw Your Screenshots

Shiny Things 218, from Rally

Rob Petrozzo, for Rally

About 5 years ago, I got a call from a friend who wanted to link me with Logan Paul, a well know YouTuber and influencer who was also in the midst of going all-in on a pro boxing career.

He said Logan was thinking of buying a very rare, very specific Pokemon card, and there might be an opportunity to work together on it.

It was still the pandemic-era, so we jumped on a zoom and Logan told me about the card. He told me the price. Then he told me what he wanted to do with it.

He was going to basically turn the card into a celebrity on its own. And he meant it.

And he had the excitement, the reach, and the momentum to make it happen.

There was a lot of money that had to come out of pocket, so after an hour or so of talking through the space and the market and the potential outcomes, I passed on behalf of Rally.

I took a screenshot at the end of the conversation, and remember thinking “this is gonna be chaotic, but I might have just missed something big.”

So now, here we are years later, and after basically going on a multi-year world tour, the card is the centerpiece of Goldin Auctions current auction at $2.6M with over a month left to bid.

The entire lead up has been a performance - but one that has done equal parts to highlight the rarity and significance of the card, as well as drive a massive return.

And maybe we missed out on it. We’ll see. But what it led me to this installment of Shiny Things newsletter is the realization that, as a society, we’ve built an ecosystem where wealth is not only accumulated or lost… its performed.

People circulate content and screenshots the way fishermen circulate stories about the one that got away. Except fish don’t usually trade at 20x earnings or wipeout the life savings of a 19 year old who put it all on the Baltimore Ravens -3.5 last week.

So this week in Shiny Things, we’re taking a look at that screenshot culture where returns are a performance, and how it may look in the future…

The new family photo album

Somewhere in the last decade, wealth stopped being something you could hold and became something you could look at. It became a tool for grabbing attention, and became the center of every conversation.

Our grandparents showed off “wealth” with physical artifacts and real assets: a house, a car in the driveway, maybe if you had real money it was a watch that eventually would get passed down.

Today, people pull out their phone, open a folder of screenshots, or a set of instagram bookmarks, and scroll through frozen money-moments when the number in the corner - theirs or that of others - moved dramatically one way or the other.

A post from a Reddit user with a screenshot showing he turned $4,000 in to $1M in 2025

Crypto portfolio peak in 2021. Meme stock run-up in 2020. The one-leg-short 1 of the 12-leg parlay. Selling NVDA at the April 4th bottom.

It’s the new photo album. Except instead of kids and holidays and days at the beach, it’s proof that for one brief moment, you were right about the world, or got so “unlucky” you had to save it.

We don’t just track wealth anymore - we curate it. We crop it, and highlight it, and save it. The market moves on, but the screenshot stays. Its a physical/digital artifact you tuck away, revisit, and show people when the conversation turns to “what could have been.”

Wealth used to be measured in acres and vaults and square footage. Now it’s measured in receipts, saved in a camera roll between a dog picture and the menu from a restaurant.

And we’re always ready… just in case lightning strikes again.

Money, gamified and moving at an unrelenting speed.

Markets used to be slow, by design. Not necessarily slower than the times, but certainly slower than the standard retail attention span.

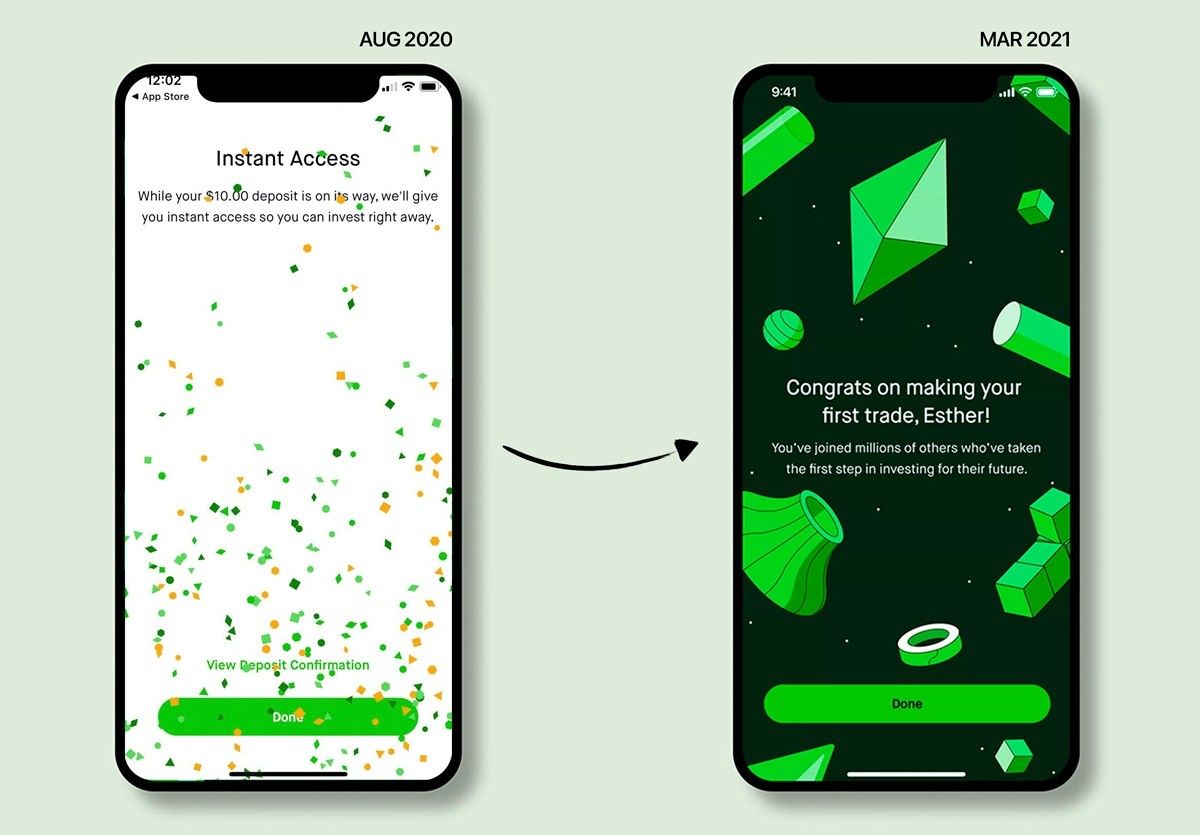

Now, wealth lives inside interfaces designed by the people with the same intentions as those who built video games in the 90s. The exchanges and wallets of today are closer to arcades than they are ledgers. It’s not that long ago that Robinhood was under fire for having confetti animations hit the screen after a trade execution (which they quickly changed into a standard “Congrats” screen).

Today, that wouldn’t even be a conversation. It doesn’t need to be… the regular market movements and green candles and all-time-high push notifications (standard app features of every consumer product) hit like MDMA IV drips.

You don’t “invest” anymore. You’re playing a game. And games need scores.

So we turn our net worth into a dashboard number that changes every second, like heart rate on a monitor. The experience is no longer “owning something and letting time do its work” (btw, compounding your way to wealth is now officially impossible). It’s watching a living organism twitch and breathe and spike and crash, and feeling like its movements say something about us.

That’s the part no one admits but every gambler knows: When the number goes down, it doesn’t just feel like you lost money. It feels like you became less of a human.

Human nature in that situation is to reach for control. Screenshots and old texts to mark a moment are control. It’s a bookmark of a moment, which now more than ever is a stopping point in net worth.

“This is how smart I used to be.”

“This is when I should have sold.”

“This is when I told you to buy Bitcoin.”

“This is the real number, ignore the rest.”

That moment now lasts forever, is shared with friends, and becomes a real memory of real gains and losses.

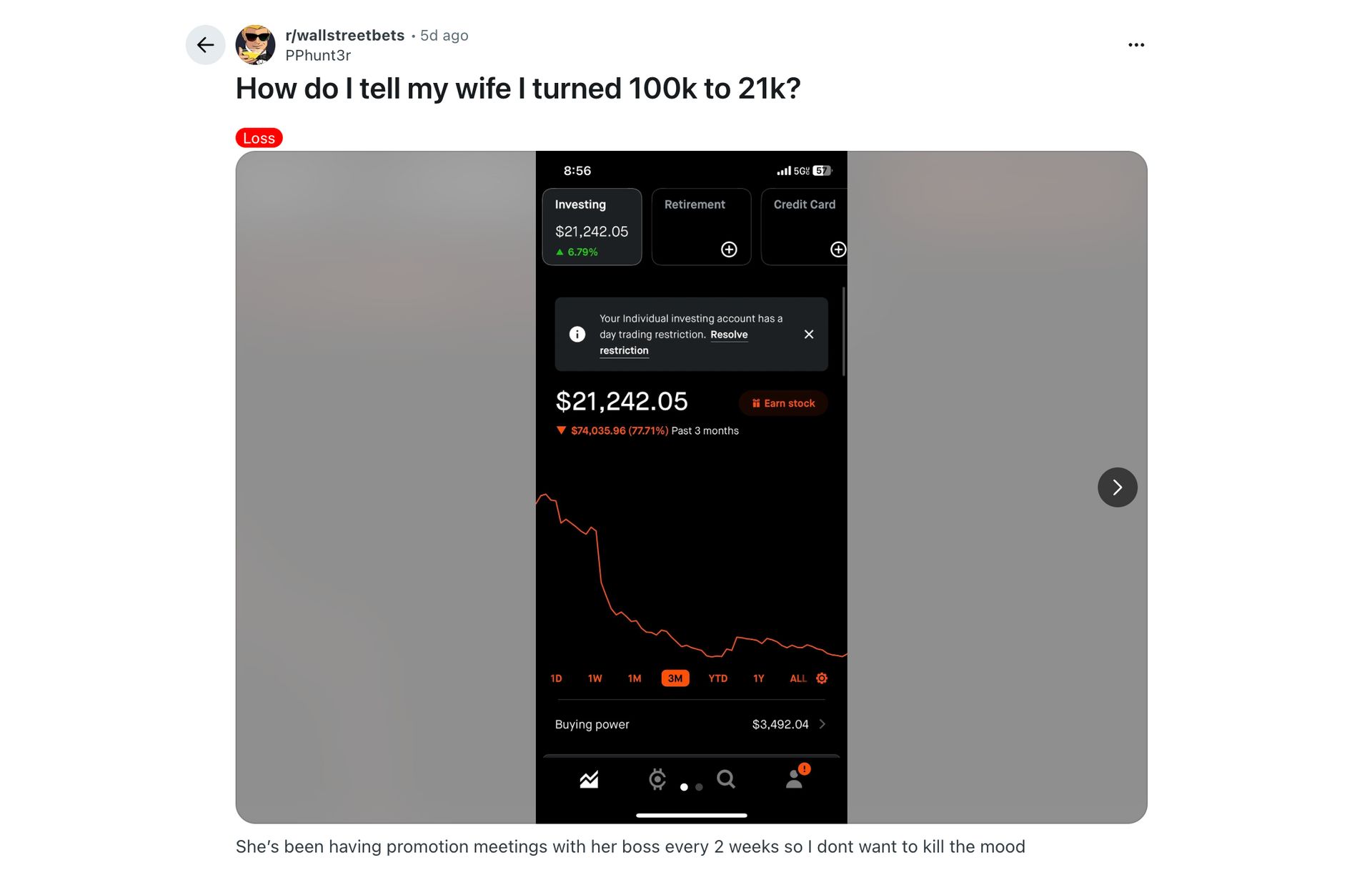

People are more often saving and sharing their personal rock bottom as a method of commiserating. When I was younger, we never memorialized the moment our portfolio set itself on fire. It’s all part of a story now though.

We curate the chapter where we were unbeatable, or the moment we said “I f*cked up bad… but now the only place to go is up!”

A new generation of investors in the casino, driven by gamification and lack of respect for earned-wealth, have created a new toy: Money.

Screenshots as coping mechanism (and quiet confession)

Screenshots of wealth are half trophy case, half confession booth. They’re proof to others, but more importantly, proof to ourselves that our thesis once connected with reality (or was ENTIRELY wrong).

The other side of reddit screenshots - a post from a user who blew $74K in 3 months from a joint account he shares with his wife.

Underneath all the noise, there’s something honest going on thats going to sound a bit too romantic for a corporate newsletter, but I’ll say it anyway:

We are terrified that life is random.

…so we hold on to moments where the world and a thesis were aligned for a second, or so disconnected that it almost feels lucky.

The same thing exists in collectibles, just with more dust and fewer LEDs. People collect because objects do not “refresh.” A game-worn jersey from 1998 doesn’t update every 4 seconds and a dinosaur skeleton does not send push notifications.

Collectibles are, in some small way, an antidote to this relentless financial existence. They refuse to be frantic. They’re a rebellion against the constant quote.

But the psychology is shared.

The signed ball on the shelf and the sealed box in acrylic and the watch that you barely wear are all physical screenshots. Fixed points in time that say: “I care about this story, and I like the version of me who owns this.”

Markets talk about P&L the way Collectibles talk about self, but they rhyme in all the important ways.

And now, all of it becomes content for better or worse.

One of the scariest corners of the flex-content internet: Forex trading coaches instagrams.

Wealth becomes less about what you can afford to do in the real world and more about how your financial narrative plays to an audience. Then the social proof becomes a multiplier.

What makes this dangerous isn’t flex culture, it’s the subtle shift underneath it: Money becomes a spectator sport instead of tool. But thats just what it is now, and thats what Gen Z watches for entertainment. So you have to meet them there if you’re a new company in the financial sector.

Nobody screenshots the quiet decisions that actually build wealth like 401k contributions and auto-investing out of your paycheck. There’s no interface for that (and definitely no confetti).

The market has always had ego baked into it, but now the stage fits in your palm, and the show never EVER ends. Our phones compress the whole messy relationship between humans and money into a single frame that says:

“Validate me. Tell me I’m not an idiot for caring this much.”

And people do. And then they check their own balances. And the carousel spins on.

What survives when the screens turn off

Despite all of this, wealth doesn’t actually live in your phone or in the screenshot or even in the balance.

It lives in optionality (and I’m realizing that you learn this only when you start to get a little older and come to terms with the fact that you might not become a billionaire like you thought you could). Its the ability to walk away and the ability to choose your time.

It’s being able to say “no” to ANYTHING.

True wealth is in the things that don’t refresh because they don’t need to.

Collecting anything at its best nudges us toward that realization. An object with history humbles you. It’s older than your portfolio and it will outlast your account login for any app you’re using right now to trade or bet on anything. You’re basically a temporary steward in a longer story. It does not care what ETH did today, or whether the Fed hiked rates, or whether someone on Reddit believes your entry price.

Owning something physical, meaningful, or historically important is often a reminder of how small you are, and paradoxically that’s where the anxiety lifts.

You’re supposed to participate in it honestly, not beat it at some make believe numbers game.

Buried inside the screenshot is the one takeaway and the one habit that is true to all humans:

We don’t actually crave money. We crave evidence that our choices mattered.

Screenshots are one way of doing that. Collecting is another. Building something, whether it’s a company, a community, a weird little museum full of stories which we did in Soho at Rally and will be doing again this year is another still.

The charts will continue to move and the markets will be irrational and theatrical and insulting and euphoric, sometimes all within the same hour or even minute these days…

and the screenshots of wild gains and insane losses and the moments where the money almost went crazy will stay in the camera roll and life will go on in the only place it ever really existed:

off-screen.

2021.

______

Until Next Week…