- Shiny Thing$

- Posts

- You're a part of it, like it or not.

You're a part of it, like it or not.

Shiny Things 220, from Rally

Shiny Thing$ #220 - A wave is building, and it’s getting closer.

Rob Petrozzo, for Rally

· · · · · · · ·

This past week, a few things happened (and are happening in real-time) in the world of money that were equal parts insanely exciting, and scary as hell.

So instead of slowly building toward a takeaway like I usually do in these newsletters, I’m going to start with it and get it out of the way:

Your dollar is no longer backed by gold, or commodities, or even the full faith and credit of the U.S. government.

It’s backed by conversation.

Not conversation in terms of the passerby-noise around us 24 hours a day, but conversation as it relates to relevance.

In 2026, the value of money and what it can buy is determined by whether something can interrupt your life often enough, across enough surfaces, to demand your attention. An object, an idea, or a narrative doesn’t need universal understanding anymore (and to be honest, the world spins so fast now that “understanding” is no longer possible unless you want to get left behind). it just needs ubiquity. If it keeps showing up, if it becomes unavoidable, then it starts to feel necessary.

This is how things move now. Not in orderly logical linear cycles, but in waves that begin in tight niches and rush toward shore like tsunamis - little hints of what’s to come, then an eerie pause that makes you think it passed, then an unstoppable wall of liquid energy that waits for (and spares) nothing in its path.

With the latest round of products and objects that make you say “holy sh*t, how did that get so expensive?” that pathway is more true than ever.

First, a small group cares deeply. Then prices start showing up in headlines. Then someone you trust asks you about it. And eventually, even the casual observer starts thinking, “I think I need this. RIGHT NOW.” It’s technically “too late” by that point. But that becomes the new floor of desire. And in today’s asset-everything society and a federal money printer that stays on in perpetuity, it usually sticks.

Post-Covid doom-scroll virality accelerated the “our money is backed by conversation” theory, but we’ve seen this movie before.

At Rally, it often starts with nostalgia. Then come auction results. Then price discovery. Then all of a sudden it’s Thanksgiving dinner, 2017 and all of a sudden your grandmother had a Coinbase account. Bitcoin’s original narrative as a transactional currency quietly disappeared, replaced by something much simpler: an asset that won the conversation war. Its value is now supported by the sheer number of people and institutions who want exposure to it. Permanence followed attention.

In the world we live in today - especially in the U.S., and EXTRA-especially when it comes to physical objects - we don’t really trade paper money for utility. We trade it for relevance. That’s an opinion, not a fact, but it’s one that’s guided how we thought about value at Rally from the beginning.

We’ve watched attention migrate from AI to precious metals to cultural artifacts and back again in a really short period of time. This rotation is inevitable. When prices reach a certain level, curiosity turns into urgency. Institutions get involved. Nee forms of liquidity show up (this year its tokenization). Celebrities and the people most consider “tastemakers” outside of the core asset follow. But none of that leads the charge.

Price does.

And the conversation that price creates is what cements future value.

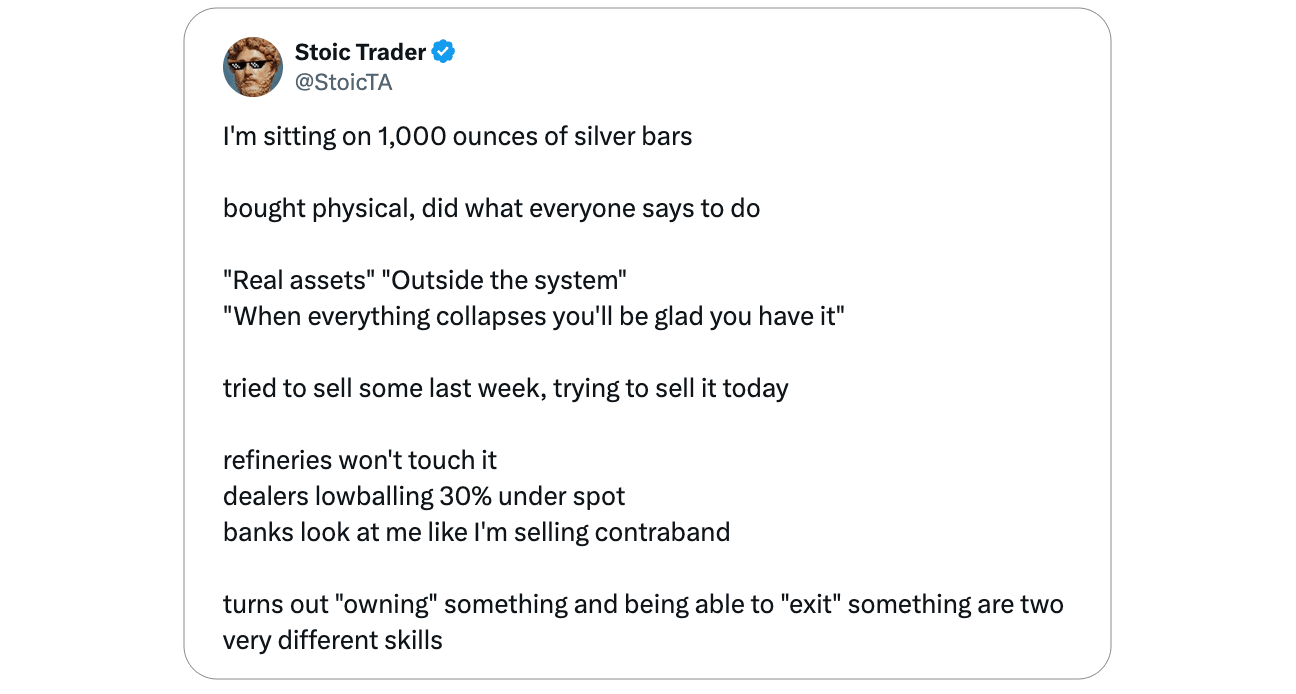

Much like recent rushes into gold or silver, many people are buying now not because they fully understand the asset, but because they can feel that something important is happening. It’s the parabolic nature of ultra-liquid conversation (even when you find out the asset itself isn’t as liquid as you thought when you jumped in and made a quick buck) 👇

Which brings us to this past week.

A few things happened in the collecting world that 95% of the public barely noticed. But within the groups that care deeply (and that second tier of people that essentially act as the first warning wave of the tsunami) the conversation liquidity was undeniable. The prices, the context, and the timing all point in the same direction…

1: $441M in collector cars sell in Florida

Rally started with cars for a reason. Our original thesis was simple: no enthusiast group was more visibly locked out of ownership than collectors in the classic and collector car market (they literally have to stand behind velvet ropes [if they even get in] at the most important auctions). For a brief window, that barrier softened. Certain nostalgic ’90s-era Ferraris and Porsches became relatively affordable, at least by collector standards. Last weekend, that window slammed shut.

At Mecum Auctions in Kissimmee, Florida, the collector car market violently repriced itself over the course of 24 hours. The result: the most successful collector car auction in history, taking place squarely in what many still consider a “down market.”

A few numbers tell the story:

A 2003 Ferrari Enzo sold for a world-record $17.875M, crushing the prior record of $2.3M.

A 1995 Ferrari F50 sold for $12.2M, eclipsing the $9.2M sale of Ralph Lauren’s F50 that was previously dismissed as an outlier.

A 1985 Ferrari 288 GTO sold for $8.52M, doubling the auction record set just two years ago.

All of these cars came from the same source: The Bachman Collection, owned by Phil Bachman. There was a charitable component, and the tax structure was favorable but none of that changes the conclusion.

These weren’t pre-war, museum-sealed race cars. Many were relatively modern classics - some not even fully crowned as such yet. And still, the market didn’t inch higher. The entire market reset.

2: A “New” Honus Wagner card, currently at $4.2M

Goldin Auctions opened an auction with the rarest and (once) most valuable card in all of collecting, the Honus Wagner T206 in Lot #1. For those unfamiliar with this card or the story of this “new” previously unknown example, you can read it here.

Long story short, Production was halted in the early 1900s at Wagner’s request, and the surviving cards quietly entered the public domain over the following decades. Today there are around 50 total. This newly surfaced example is graded PSA 1, meaning it ranks at the bottom of the 1-10 condition scale. With Wagner cards, condition matters far less than narrative and scarcity though. The object is the story.

There was no published estimate, but within collecting circles, expectations hovered around $2–4M…

Three days into the auction, with nearly a full month remaining, the card is already sitting at $4.27M, with 30 bids placed and nearly a FULL MONTH left in the auction.

For context: the last PSA 1 example sold for $3.1M in 2022, while a higher-grade PSA 3 sold for $6.6M, both of which were considered landmark moments at the time. This auction is now positioned to surpass them comfortably, and potentially rewrite the entire hierarchy. From a somewhat educated perspective as someone who secured a Wagner for Rally, my belief is that there is a very real chance this card flirts with $10M.

More Wagner cards will now surface. Price expectations for the highest-graded known example - a PSA 8 - move toward $50M+, a valuation previously reserved almost exclusively for top-tier fine art. That shift doesn’t happen gradually. The entire market (will now get) reset.

3: A $5.6M Declaration of Independence

When Rally acquired our original Declaration of Independence broadside in 2021, the most common reaction was“They made more than one?”

After explaining that roughly 200 examples exist (printed and distributed throughout the colonies in 1776 so the text could be read aloud publicly) the next response was almost always the same: “That has to be worth 10 million.”

Our copy IPO’d at $2M.

In context, that always felt low (not investment advice). And we weren’t alone. Last week, the market spoke. An identical broadside - an exact comp to Rally’s - sold at auction for $5,687,000, blowing through its $3M - $5M estimate, which, rumor has it, had already been raised from $2M - $3M shortly before the auction preview. That’s not incremental appreciation. That’s actual repricing and direct connection to the relevance of that item in the current social and economic context.

These pieces rarely come to market, but when they do, they recalibrate everything around them. At this level, the implications extend immediately to the earliest Dunlap broadside printings, of which only a handful are known to exist. For context, one sold in June of 2000 for $8.14M. Those are now plausibly valued in the $30 - 50M range. The entire market reset.

All of these sales happened just LAST WEEK, as the dollar completed one of the largest one-year declines in value in U.S. history.

For those paying attention, these were oh-shit moments. For those just on the edges of the conversation, they were headlines. For everyone still on the sidelines, they’re about to become new-market moments.

Everything is becoming an asset. And everything is becoming investable.

Just as important, and a major source of the energy behind this wave, is who is selling. The consignors behind these record-setting assets belong to an aging generation that spent decades acquiring, preserving, and quietly holding onto objects that mattered deeply to them. Now, they’re entering the market as sell-side liquidity.

Phil Bachman passed away in 2025 at age 87, with instructions for his collection to be sold in support of charitable causes. The Honus Wagner at Goldin traces back to Morton Bernstein, who acquired the card in the early 1900s and passed it down through his family before it was consigned. The Declaration of Independence broadside was listed by a 91-year-old collector of American history.

This is the great wealth transfer happening in real time, where historically significant objects are meeting global liquidity for the first time. And they’re not just trading hands. They’re setting world records way earlier in the cycle than ever anticipated.

Great is separating from good. Access and capital are flooding auctions and private sales alike. This isn’t a niche anymore.

This is the new gold.

I say all of this to make one final point: there are roughly 250,000 people subscribed to this newsletter. If you’ve read this far, you’re already part of the conversation… It’s going to now find its way to a group chat, or a Slack thread, or maybe just quietly in the back of your mind and you’ll be reminded of it when you inevitably see the next big auction result or a headline about the insane price some random object sold for.

That’s how value spreads now. Not all at once, but person to person. Moment to moment. You’re in it now.

This is where it starts.

I’ll have more to say on this in the coming months, but what’s happening right now is unprecedented and it’s accelerating. As I was writing the outline for this newsletter, I received a text from someone I hadn’t spoken to in three years: “Yo - don’t you guys have a Honus Wagner card?” He’s never asked me about Rally or cards of any kind before. The last time I got a message like that was when my grandmother asked if she should buy an iPhone.

Markets are resetting and the wave is building global momentum.

It’s time to start paying attention.

· · · · · ·

Until Next Week…