- Shiny Thing$

- Posts

- ST 193 ✨ Bitcoin is a Collectible?

ST 193 ✨ Bitcoin is a Collectible?

the money problem.

On Wednesday, Sotheby’s wrapped one of the most eclectic auctions in recent memory. Part of its “Geek Week” series, the sale featured everything from a pristine Apple-1 computer to a 150-million-year-old Ceratosaurus skeleton - the only known juvenile example, and one of just four full specimens in existence.

What made this auction particularly interesting wasn’t just the lots. It was the mix...

Space memorabilia, minerals, tech relics, art, and fossils all sat side-by-side. The collecting world is flattening. Younger collectors care less about categories and more about emotional connection. Dinosaurs and programmatically created art now live in the same exhibit.

And just beneath the lot descriptions? A small link that reads: “Cryptocurrency Accepted.”

Sotheby’s now accepts crypto for more than just NFTs. Which means someone could soon be paying for a prehistoric dinosaur (which sold for over $30,000,000 😳) with Bitcoin, a currency that’s not yet old enough to drive.

Is Bitcoin a currency… or a collectible?

The argument for Bitcoin as money gets weaker by the day, especially with BTC now topping $120,000. Sure, you can use it to buy things, but who wants to spend an asset that's appreciated 84% annually over the past decade on a $4 latte? Despite its technical fungibility, Bitcoin still isn’t recognized as legal tender by any major nation.

But if it’s not a currency, it might be something even more interesting: a collectible.

By definition, collectibles derive value from scarcity, demand, condition, and community. The best ones also basically require conversational liquidity, relevance, and a shared mythology. And in that light, Bitcoin checks a lot of boxes.

Let’s break it down:

Scarcity: Capped at 21 million. That’s a smaller supply than most trading card companies print per year.

Subjective Value: Much like a Warhol or a first-edition Hemingway, its worth lies in what someone will pay.

Emotional Appeal: Bitcoin’s loyal holders are as passionate, and as tribal, as Pokémon collectors (and Pokémon is one of the largest global IPs on Earth).

Market Volatility: Like many collectibles, Bitcoin rides the waves of speculation. But unlike memorabilia or comic book investors, BTC holders don’t pretend it's just a hobby. It’s about making money, and they’ll proudly say so.

It even has physical artifacts.

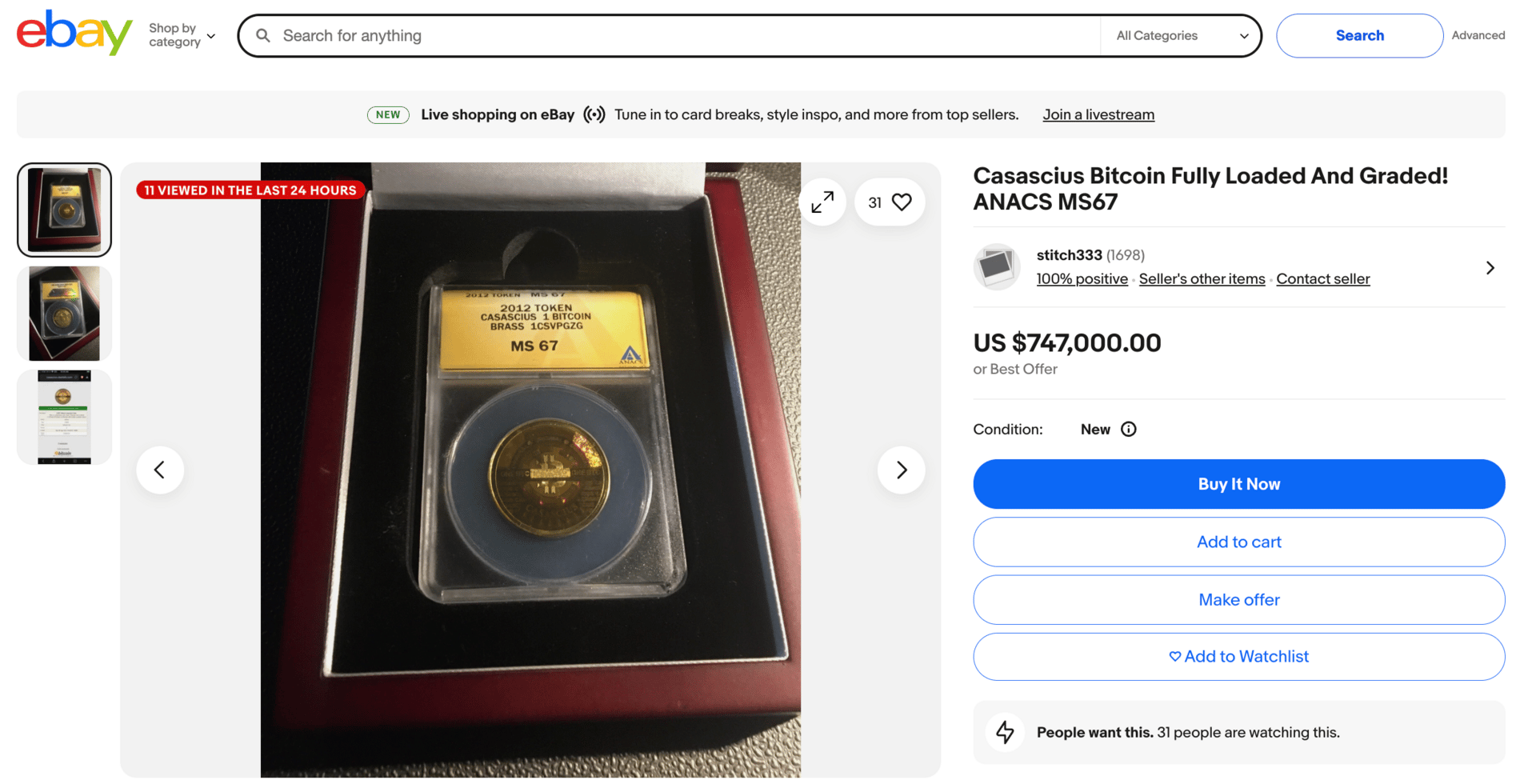

One of the earliest examples: the Casascius Coin, a physical bitcoin loaded with a redeemable key. Minted in 2011, these coins now trade for more than the BTC they contain. Even emptied ones fetch thousands as relics of crypto’s early days.

And yes, it has a community. In the mid-2010s, a fringe concept known as the “21 Club” emerged across reddit and social media circles, symbolic status for those who owned 21 BTC (0.0001 of the full supply). Only 1 million people could ever theoretically be part of it. Pure collector logic. There’s no “Million Dollar USD Club” after all…

Add to that the meetups, conferences, street marches, and even the occasional costume party, and you’ve got a full-fledged collecting subculture - just with more charts.

So where does that leave Bitcoin?

Well, it’s probably unwise not to own at least a little (NOT FINANCIAL ADVICE!!). Institutional support has surged. Big banks are telling clients to get exposure. ETFs are live. The momentum is real.

But here’s the truth that might keep Bitcoin from ever becoming true money:

No major economy will willingly give up control of its monetary system to something it can’t regulate.

And that may be where the argument ends (for now).

In the meantime, Bitcoin sits near all-time highs. Collectors are chasing meaning across every niche imaginable. And the first monetary asset in centuries that built a market from scratch might just end up in everyone’s portfolio - not as currency, but as a cornerstone collectible.

You’ll just need to move quick if you want one… there’s only 21 million available 😉

Until next week…